What do we know so far, and how can we learn from international business research?

Platform papers is a monthly blog covering the latest academic research on platform competition. Blogposts are written by prominent scholars based on their research included in the platformpapers reference dashboard. This month’s blog is written by Liang Chen.

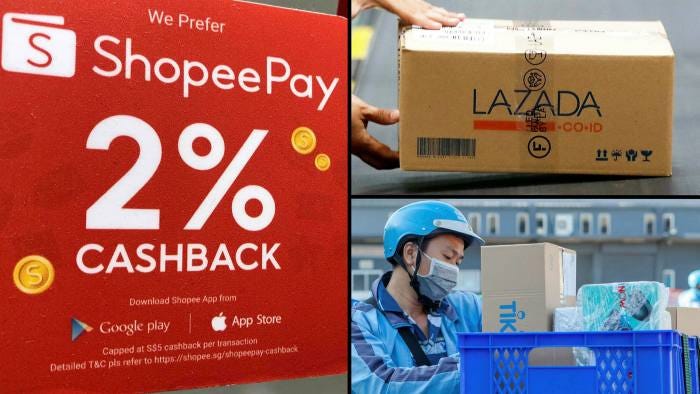

Pundits often rave about platforms dominating the digital economy. But have platforms lived up to the hype in global markets? Not quite, except perhaps for a handful of big names. Even for a posterchild like Alibaba, it was struggling right at the doorstep in Southeast Asia—the acquisition of Lazada stumbled into cultural clash and saw heavy CEO turnover in only a few years. Shopee, a start-up in Singapore, ended up becoming the region’s retail powerhouse and outgrew Alibaba’s entire international e-commerce. What went wrong? Is winner-take-all a mirage on the global stage?

International network effects, or not?

The hype about platforms is based on network effects. If foreign users and complementors are drawn to a fast-growing platform, international success should be a natural extension of domestic dominance. Conversely, when network effects decline across the border, we cannot expect platforms to dominate international markets. For some industries like ride-sharing and digital coupons, users mostly consume products and services offered by local complementors. On social media, users may be only attracted to local complements due to common preferences. Despite the frenzy about network effects, it is not rare that platforms must establish the ecosystem of users and complementors in a new country from scratch.

Multinationals vs platforms

International business (IB) scholars have been studying firms’ foreign expansion for decades. The focus has always been on multinationals—why they venture abroad, where they expand, how they enter each market, and how well they perform. A consensus arises that establishing a physical operation overseas can circumvent the transaction costs associated with cross-border dealings. Equity entry, i.e., setting up a foreign subsidiary, is considered the default mode—otherwise we would know no multinationals. But platforms are a different beast. A platform has a loosely coupled relationship with its complementors without which it is simply of little use.

While multinationals mandate what a foreign subsidiary should be doing, platforms seek to get complementors on board and prompt them to create value. Managing a subsidiary across borders is hard; coordinating a loosely coupled network of complementors surely is even harder. On the one hand, platforms rely on complementors’ local knowledge and initiative in exploring new use cases and offering locally appealing products and services. To achieve this, complementors must have substantive autonomy. On the other hand, platforms need to push complementors to make platform-specific investments. Such investments help create more value (e.g., by differentiating the platform), stronger synergies with other complements in attracting users, and they can increase switching cost for complementors. Yet only when the platform exerts a certain degree of control will complementors be willing to make such platform-specific investments. The balance between autonomy and control is a tricky one and poses an ongoing challenge in an unfamiliar market.

Ecosystem-specific advantages

IB scholars traditionally depict multinationals using the notion of firm-specific advantages (FSAs). FSAs mostly derive from intangible assets, and they determine internationalization strategies and outcomes. But we all know platforms are called platforms precisely because they are not defined by proprietary assets alone. In competing with rivals abroad, platforms need ecosystem-specific advantages (ESAs) instead. ESAs arise when a platform has a great number or range of complements, when the activities within the ecosystem are highly complementary as shown by Amazon’s flywheel, and when the platform firm can govern the complementors such that their interests are aligned with the platform’s goals.

However, the transfer of ESAs across borders appears challenging. The platform will likely face a chicken-and-egg problem every time it expands into a new country. When a multinational platform cannot piggyback on its existing advantages to gain a head start, the risk of being outsmarted by a local rival becomes a real concern. After all, a local competitor will know the market better and it is not constrained by a globally consistent interface or design. Moreover, platforms may find it frustrating that even one technical bottleneck in the local market could paralyze the flywheel and deprive the platform of its ESAs. Alibaba is known for its commitment to an asset-light platform model; yet it had no choice but to invest extensively in logistics across Southeast Asia, and it also deployed the domestic logistic arm Cainiao to help enhance Lazada’s delivery efficiency. Still, the sluggish adoption of digital payment across the region poses another roadblock to leveraging Alibaba’s ESAs.

Charting new courses

As platformpapers keeps adding new publications, it is also getting clearer that our understanding of platform internationalization is still in its infancy. A closer look at IB scholarship may unveil several avenues worthy of future research endeavors.

Would we benefit from new theoretical lenses for studying multinational platforms? IB has heavily utilized transaction cost thinking in characterizing multinationals. But platforms “externalize” rather than “internalize” operations. In my research, I argue that property rights theory may be the most appropriate tool. You might agree or disagree, but the time is ripe for alternative perspectives.

In IB, local adaptation is key to success. But adapting what? On a platform, complementors will mostly take care of the adaptation of product offerings. What seems intriguing is whether and how platforms effectively adapt their governance strategies to the conditions of a new market. Failures in certain foreign markets may be attributed to an inability to adapt platform governance and design, rather than simply cultural differences.

Scholars exhibit a growing appetite for linking corporate strategy with platform research. As an example, Uber continually reconfigures its portfolio in different countries; it doubled down on ridesharing in some markets while prioritizing Uber Eats (especially grocery delivery) in others. But we don’t have a clear idea why. In Hong Kong, Uber just shut down food delivery and turned its focus to Uber Taxi. How is this different from resource redeployment? Why do platform firms diversify into other businesses (often through acquisition) in a foreign market?

Regulators always play a salient role in IB, but perhaps more so for platforms. Changes in regulation can force changes in the business model and even illegalize a platform business to the extent that it must divest (e.g., Airbnb quitting Berlin in 2016). On the contrary, Grab worked closely with Thai authorities for years—despite ridesharing being illegal—and sought support from all major parties in the 2019 general election. IB research has a lot to say about non-market strategy and may be particularly informative on how platforms can establish legitimacy in a foreign territory. We know that corporate social responsibility has been an effective means, and perhaps “ecosystem social responsibility” is the next big area for researchers to explore.

Research on emerging market firms suggests that they venture abroad to escape from underdeveloped institutions at home. Platform firms, too, may be escaping from home regulations that are either too restrictive or misaligned with other countries. It is no coincidence that Chinese household names like ByteDance, Tencent, and Alibaba all embarked on hiring sprees in Singapore lately. This also raises the overlooked question of what kind of places will be favored by platform firms for establishing physical operations.

To be sure, platform scholars are paying growing attention to country differences (e.g., regulations), and it has proved exciting to work out the various implications for platform strategy. The question is: can our research keep up with the way platform businesses expand globally? I believe that the dialogue between IB and platform researchers is no longer an option but an imperative.

This blog is based on Liang’s research published in the Journal of International Business Studies and is included in the platformpapers reference dashboard.

Chen, L., Li, S., Wei, J., & Yang, Y. (2022). Externalization in the platform economy: Social platforms and institutions. Journal of International Business Studies, 1-12.

Li, J., Chen, L., Yi, J., Mao, J., & Liao, J. (2019). Ecosystem-specific advantage in international digital commerce. Journal of International Business Studies, 50(9), 1448-1463.