Successful platform ecosystem orchestration requires more than network effects alone

This blog is written by Melissa A. Schilling.

One of the key jobs of a platform ecosystem’s sponsor (or “hub”) is to find a way to overcome the classic “chicken-and-egg” problem that new platform ecosystems typically face, i.e., the ecosystem may not be valuable to one or more types of participants until it has a critical mass in other types of participants. For example, video game consoles need games to be attractive to attract buyers, but game developers prefer to develop games for consoles that already have a lot of users; drivers are not interested in joining a ride sharing platform until there are a lot of customers, and customers get little value from using a ride sharing service until there are a lot of drivers, and so on. As a result, solving the “chicken-and-egg” problem has received considerable attention by both scholars and managers (see a great blog post here), and many platform managers see this as the crux of thjob.

Gettingthe point where the platform ecosystem has enough of the right kinds of participants is crucial to survival and should be celebrated, to be sure, however this is just where it starts getting interesting. A strong platform strategy should leverage several other levers to increase the value creation and capture in the ecosystem. I’ll discuss three here: Selective promotion to unlock stars and manage customer perception of depth and breadth, leveraging the data to build and refine new products and services, and facilitating scale benefits individual complementors could not achieve on their own.

Selective Promotion

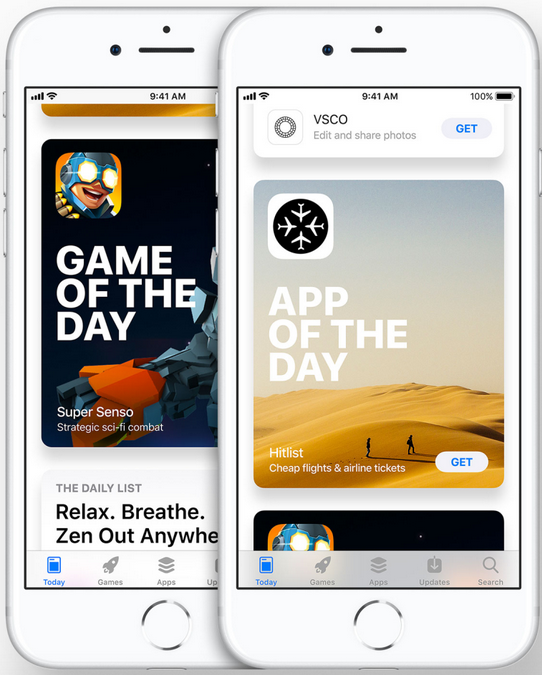

Through selective promotions like endorsements, awards, marketing campaigns, and more, the platform hub can direct attention to high quality complements that deserve more attention than they are getting, thereby increasing the likelihood that they become “stars” in the ecosystem. This type of attention directing by the hub can be very powerful. Apple provides a great example: When Apple features particular applications on the home screens of its iOS App Store in categories like “Editor’s choice,” “App of the Day,” “Best new Games,” those applications may get up to six times as many downloads as other applications during the period they are featured.

Furthermore, through selectively targeting different types of applications, a platform hub can manage end-users’ perceptions of the range and overall quality of the ecosystem, and can spur consumers to try a broader range of products from the ecosystem. Consistent with this, research by Rietveld, Schilling and Bellavitis (2019) on video games found that platform sponsors select games for endorsement not only based on their quality and sales performance, but also on the degree to which they can unlock unrecognized value in the game, and the game’s potential to enhance the balance of the overall portfolio. Specifically, platform sponsors were more likely to endorse games that had high quality and good initial sales but were not market leaders. Additionally, they were more likely to endorse games that were in a high-value genre.

Leveraging the Data

The hub of a platform is often in a unique position to capture and utilize the data generated by the platform. Many platforms use the data to create better experiences for their customers, such as through providing recommendations and reviews. However, platform hub managers often do not fully leverage the opportunity to more proactively collect, use and sell data that could increase the value of existing complementors, or to catalyze the creation of complements that do not yet exist.

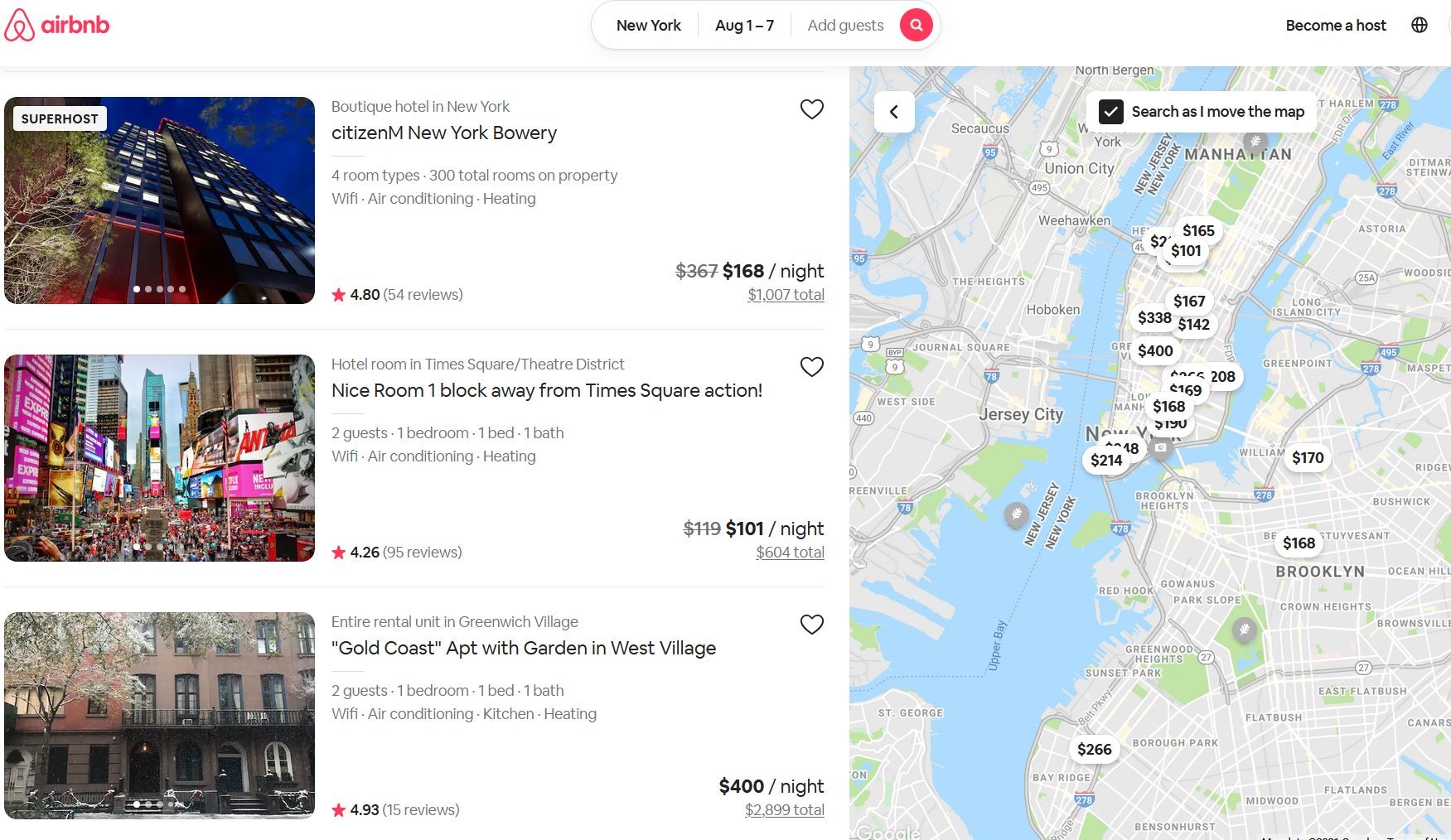

For example, lodging platforms like Expedia and Airbnb have access to exceptionally rich data on which lodging options customers choose and at what price. Not only do they have aggregate data on market trends in lodging, but they can also track a user’s choices over time and assemble a portfolio that tells them a lot about what that customer values and how much they’re willing to pay for it. They also have access to review scores and comments lodgers leave after their experiences. Both Expedia and Airbnb provide the review scores to other customers and utilize them (to varying degree) in search rankings, and Airbnb uses customer choice data in its dynamic pricing recommendations it makes to hosts. However, both platforms could be making considerably more use of their customer data. For example, both platforms could be providing data to their lodging providers on the degree to which customers would value additional features such as in-room dining, basic kitchen appliances, acceptance of pets, etc. They are uniquely positioned to help lodging providers in a given locale differentiate themselves to better tap underserved market segments. They can even identify geographic locations in which particular market segments are not being served at all and advise developers on opportunities that exist to develop or expand the range of hotel offerings, or they could even choose to develop these lodging options themselves!

One company that has done this exceptionally well is the popular movie streaming platform, Netflix. In 2017, Netflix started Netflix Studios, and began recruiting some of television’s most successful writers and producers to start making original content in house. By 2021, Netflix was spending over $5 billion on original content, making it one of the largest film production companies in the world. For a movie rental service to vertically integrate into developing its own content seemed a peculiar move at the time, because making films and television shows requires fundamentally different technology, equipment, personnel, and expertise than distributing films and television shows. What could a specialist in media distribution know about media production? A lot, it turns out.

Netflix’s rapidly growing datasets enabled it to know which customers liked which films, which genres were growing, which new stars were gaining followings, which new production houses were gaining traction and more. The relationships it had cultivated with small independent filmmakers and budding actors also helped ensure the firm’s access to a pipeline of new creative talent and helped build goodwill toward the company. Sean Fennessey, a writer for pop culture website The Ringer, explained how important Netflix was to frustrated filmmakers who could not raise enough support to get a major studio movie off the ground, “To the creators stifled by the rise of Hollywood’s all-or-nothing focus on franchise films, Netflix felt like salve on an open wound.”

Netflix also used its massive distribution reach and selective promotion to drive viewers to its original content, building audiences for its series and crafting its reputation as a first-tier production house. Netflix profited in multiple ways from its original content: Having popular exclusive shows helped attract and retain subscribers, and having both a large audience and a powerful library of original content gave it more bargaining power when negotiating license fees for content produced by others. Collectively, it was a powerful advantage.

In some platform ecosystems, the platform hub’s diversification into its complementor’s business could create more harm than benefits. Complementors with many platform choices, for example, might prefer opt to participate in platforms in which the hub is not a direct competitor – a dynamic known as “channel conflict.” In this situation, the platform hub can instead offer its data and advisory services to existing complementors and would-be complementors rather than entering these businesses through direct ownership.

Facilitating Scale Benefits

Another way in which a platform hub can help to unleash greater value in its ecosystem is through identifying those activities of complementors that would benefit by greater economies of scale, and either providing assets for those activities that complementors can access or providing another means by which the complementors can pool their scale. For example, if multiple complementors would benefit from the development of a powerful data analytics engine or sophisticated advertising capabilities, the platform hub can either provide those activities itself, or help to convene collaborative relationships that enable its complementors to share that effort and expense.

A great example of this is provided by Soteria Investments, a platform created to facilitate the buying and selling of distressed debt. The buyers and sellers of distressed debt are of highly variable size; a handful of large banks and investment firms make hundreds of transactions a year, while the vast majority of players make less than a dozen transactions a year. The buying and selling of distressed debt was historically a human-mediated transaction – sellers either searched for buyers directly among their contacts, or hired an investment banker to search on their behalf and then paid that investment banker a retainer fee, commission, or both. Furthermore, the deal flow in distressed debt is very segmented by geography and industry – a given seller might only have construction loans in the Midwest for sale, for example, giving them relatively little exposure to overall trends in deal flow and pricing, while also giving them inadequate incentive to invest in acquiring and analyzing a broader and deeper base of data. By providing a platform for buyers and sellers to find each other, Soteria helps a wider range of buyers be exposed to a wider range of sellers, while also collecting multinational and multi-industry data on deal flow and pricing. Access to that pooled data also gives it both means and incentive to invest in state-of-the-art data analytics capability that it can then offer to participants in its ecosystem, helping them to achieve more efficient pricing, greater control over risk, and faster transaction consummation.

Notably, facilitating the pooling of scale has another benefit to the platform hub: by enabling complementors to obtain the benefits of larger scale without actually achieving larger scale can help keep the complementors on a more level playing field, preventing one or a few from rising to a dominant position that increases their bargaining power over the hub.

Now you’re ready to orchestrate!

This process of managing an ecosystem to help participants be more successful both individually and in combination is usually termed “orchestration.” The platform manager is like a conductor that directs all the players to perform in ways that come together into a harmonious whole. It’s a complicated job – there are complex competitive dynamics and other interdependencies between the participants in an ecosystem that require careful thinking through. The platform hub manager must also take care to not be too heavy handed lest they alienate their complementors – rather than hierarchical authority, most platform hub managers rely on incentives and guidelines that are to some degree jointly negotiated with the complementors themselves. But if orchestration is well done, the ecosystem becomes much more powerful and valuable than the sum of its parts.

This blog is based on Melissa’s research published in Organization Science, which is included in the Platform Papers references dashboard:

Rietveld, J., Schilling, M. A., & Bellavitis, C. (2019). Platform strategy: Managing ecosystem value through selective promotion of complements. Organization Science, 30(6), 1232-1251.