Does corralling a dominant platform help complementors?

This blog is written by Sruthi Thatchenkery and Riitta Katila.

Digital markets are increasingly dominated by a small number of technology platforms, prompting fears that platform owners may abuse that market power. Of particular concern is the threat that dominant platforms pose to complementor firms that depend on the platform for access to customers. For example, Google has been fined by the EU for privileging its own review and shopping comparison results over competitors on its search engine. Similar concerns have been expressed regarding Amazon promoting its own products over third party sellers in its online retail business or Apple leveraging excessive fees on developers through its App Store.

Traditionally, antitrust regulators focused on preventing firms from achieving a dominant market share in the first place, outlawing actions aimed at monopolizing markets and blocking mergers and acquisitions between firms with already high market share. But outright preventing platforms from growing to dominate their markets may be difficult, since platform markets are characterized by powerful network effects that create significant returns to scale and often yield winner-take-all outcomes. Breaking up platforms that become “too big” therefore may not be viable nor even beneficial to consumers.

Perhaps, then, it is more feasible to restrict a platform’s ability to exploit the market power that comes with massive scale. Regulators around the world are attempting to do so via newly introduced antitrust legislation, such as the Digital Markets Act in the European Union and the American Innovation and Choice Online Act in the United States. In a break from typical antitrust tactics, these new regulations do not seek to stop platforms from accumulating dominant market shares; instead, they enact rules that are meant to prevent large platforms from using that dominance to block fair competition and, in turn, innovation. But will constraining the behavior of an already-dominant platform actually restore competition and spur innovation in platform ecosystems?

In a recent paper, we attempt to shed light on that question by examining how a landmark antitrust intervention against a dominant tech platform impacted complementor firms. Specifically, we analyzed United States v. Microsoft, the first major antitrust case against a digital platform in the US.

The allegations against Microsoft were starkly reminiscent of what firms like Google, Apple, and Amazon stand accused of today: Microsoft purportedly used its dominance in operating systems (i.e. platforms) to block application developers’ (i.e. complementors’) visibility and access to customers, limiting innovation and customer choice. In 2001, the U.S. Department of Justice and Microsoft resolved the case via settlement, in which Microsoft agreed to stop engaging in activities that had been deemed anti-competitive, such as blocking customers from uninstalling its own complementor applications or punishing OEMs that tried to promote third-party complementor products.

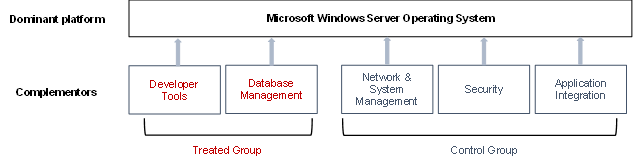

While popular attention focused on “the browser wars” between Microsoft and Netscape, the allegations against Microsoft extended broadly across both consumer and enterprise software. We specifically examine the effects of the settlement in the enterprise infrastructure software industry. Infrastructure software consists of back-end applications that allow organizations to manage and maintain complex IT systems. The industry is divided into five complementor product markets – application development, application integration, database tools, network and system management, and security – which run on central platforms known as server operating systems. At the time of the intervention, Microsoft owned the dominant platform in the industry (Windows Server) and competed in all five complementor markets. However, Microsoft only achieved significant market share in two complementor markets: database tools and application development.

From a research design perspective, this variation in Microsoft’s complementor market share allows us to distinguish between markets that are likely to be sensitive to the intervention from markets that are not. In the “treated” complementor markets where Microsoft held significant share, the intervention suddenly constrained a powerful competitor, opening up strategic possibilities that may not have seemed viable before. In contrast, in the “control” markets where Microsoft held only minimal share, the intervention would not significantly change the competitive environment. Examining post-intervention differences between complementors in the treated versus control markets can thus yield insight into the impact of the intervention.

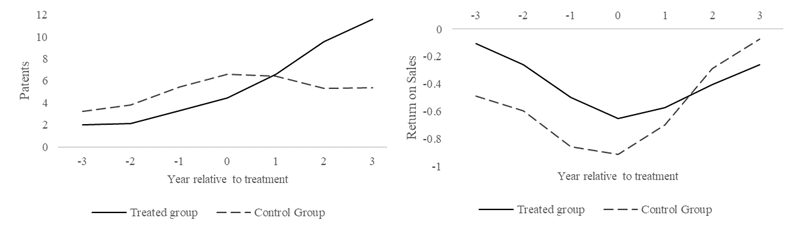

What we find is that the Microsoft antitrust intervention was a mixed bag for complementors: innovation went up, but profits went down. On the positive side, complementor innovation (measured as patents or R&D expenditures) increased in treated markets, particularly among those with the lowest market share. So, the intervention did in fact spur innovation among the complementors that would have been most vulnerable to Microsoft’s dominance. However, profitability dropped in treated markets – again, particularly among the complementors with low market shares. High market share complementors (who arguably did not require the same protection from regulators) did not significantly increase innovation nor did they suffer a profit penalty. Thus, while the intervention successfully prompted technical innovation, the firms that innovated did not actually benefit financially.

Why couldn’t complementors translate innovation into profits? Our interviews with industry experts indicate that complementors may have been more reliant on Microsoft than they had realized. Platforms like Microsoft often provide essential assets such as development tools to complementors in order to foster innovation on the platform. After being restrained by antitrust intervention, a dominant platform may not be as willing or able to freely share those assets, forcing complementors to incur the costs of developing replacements themselves. Indeed, several such assets were withdrawn by Microsoft after the settlement. Complementors – especially low-share complementors – were thus able to innovate but lacked the assets to bring those innovations to market in a profitable way.

Complementors and platform owners should therefore be mindful of complementor dependence on platforms. Complementors should not assume that antitrust action against platforms will be solely beneficial to them and should instead seek to develop resources and capabilities that allow them to profitably capitalize on innovation opportunities that might emerge. Platforms, meanwhile, should not encourage excessive dependence among complementors, as the long-term viability of a platform ecosystem depends on a fostering a variety of high-quality complements – a task that requires a healthy population of complementors innovating on the platform.

For regulators, our findings do offer some encouraging evidence that conduct remedies (i.e. interventions that restrict the behavior of dominant firms) can be effective in sparking technical innovation in platform ecosystems. But, innovation without profit is unlikely to foster healthy competition in the long term, particularly if profit penalties are disproportionately suffered by smaller, more vulnerable firms. Antitrust intervention that places shackles on dominant platform is therefore not an automatic cure for competition concerns. Instead, taking targeted steps to reduce complementor dependence on platforms for essential assets (or ensure those assets remain available after intervention) could be a potential win-win for both platforms and regulators: it could reassure regulators wary of abuse of platform market power while also benefitting the platform by invigorating profitable innovation across its ecosystem.

This blog is based on Sruthi and Riitta’s research published in the Strategic Managment Journal, which is included in the Platform Papers references dashboard:

Thatchenkery, S., & Katila, R. (2023). Innovation and profitability following antitrust intervention against a dominant platform: The wild, wild west? Strategic Management Journal, 44(4), 943-976.